Architects & Accounts: Navigating the Financial Landscape of Design Projects

Financial oversight and planning play a pivotal role in the success of architectural projects. Architects must not only be masters of design but also adept at managing the project’s financial health.

Understanding the costs involved in architectural projects, from material selection to labor, can mean the difference between a profitable endeavor and a fiscal misstep.

Coupling design expertise with financial acumen allows architects to steer their projects through complex economic landscapes, ensuring both aesthetic and fiscal responsibility.

Navigating the financial aspects of design involves more than just budget management; it requires a comprehensive grasp of accounting basics and strategic financial planning tailored specifically to the field of architecture.

This holistic approach empowers architects to make informed decisions that balance creativity with cost-effectiveness.

Key Takeaways

- Effective financial planning is essential for successful architectural projects.

- Transparency and strategic planning are key in balancing design with affordability.

- Incorporating specialized financial tools and practices enhances project management.

The Foundation: Understanding Project Costs

Understanding project costs is vital for effective budget management and cost control in architecture. They form the spine of design project financials and require detailed analysis to ensure accurate forecasting and spending.

Breaking down the Budget

In architecture, a well-structured budget is the cornerstone of fiscal oversight.

Precise budget allocation involves distributing funds across various domains like design, materials, and labor with a strategic approach tailored for each project.

Materials

The materials subsection details every physical component required to turn the blueprint into reality, including costs for sourcing, transportation, and wastage.

Architects must ensure the construction cash flow projection accurately reflects these expenses for financial health.

Labor

Labor costs extend beyond salaries to include benefits, insurance, and overtime. Effective projects often employ strategies to optimize these expenses without compromising on work quality or adherence to timelines.

Permits and Fees

Permits and fees can represent a substantial portion of total expenses. They are not only mandatory but vary by locality, scope, and project type. An architect’s grasp on this aspect ensures compliance and seamless project progression.

Contingencies

Contingency funds are essential to safeguard against unforeseen events impacting project finances. Typically, a percentage of the total budget is earmarked for this purpose, influenced by the project’s complexity and risk assessment.

Designing Profitability: Financial Strategies for Architects

In the world of architecture, successful fiscal oversight is as crucial as the design itself. It can dictate the sustainability and growth potential of any design firm.

Blueprint for the Bottom Line

To ensure profitability in architectural practice, firms must establish a clear business planthat includes revenue projection, overhead expense budget, and profit planning.

Based on industry insights, it’s critical to regard financial stewardship as a core element of a firm’s activities, ensuring the firm remains competitive and sustainable in the market.

Various Financing Strategies for Design Projects

Financing strategies for design projects play an essential role in the financial landscape for architects. Strategies may include traditional bank loans, project financing, and innovative funding sources such as crowdfunding.

Interest in sustainable projects has given rise to green financing options. Firms may explore grants and subsidies for projects with environmental benefits.

Experts in the field emphasize the importance of meticulous financial planning. “Understanding your profit margins and managing the cash flow effectively is the bedrock of a financially stable architecture firm,” remarks a seasoned managing partner from a New York architectural firm. This underscores the idea that precision in financial oversight can lead to sustained success in the industry.

The Art of Billing: Best Practices for Architects

Architects face unique challenges when it comes to billing for their services. It’s not just about recording time spent; it’s about ensuring value for the client while also maintaining the financial health of the firm.

Invoicing with Integrity

Invoicing is the crucial moment where financial documentation and client trust intersect. For architects to invoice with integrity, transparency is key.

Invoices should clearly detail the services provided, separating time spent on various tasks with specific rates. This differentiates hours allocated for conceptual design from detailed drafting or project management.

Firms can consider using strategic billing methods, which may include hourly rates by role, milestone billing, or fixed fees, ensuring a fair and straightforward accounting of the work.

How to Bill Clients Fairly and Transparently

Billing fairly means setting expectations from the start. Prior to beginning any work, an architect must discuss their billing structure with the client.

Whether the billing is per hour or per project, clear communication upfront can prevent disputes down the line.

To facilitate this process, an architect may draw from recommended billing practices, ensuring that the client comprehends the correlation between the rates and the value delivered.

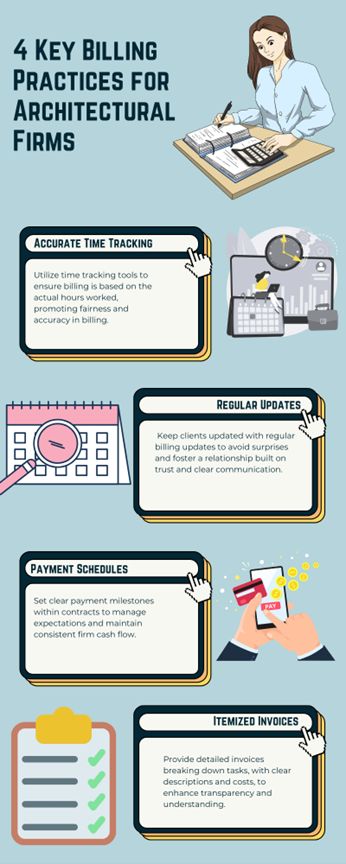

Key Billing Practices

- Itemized Invoices: Break down the invoice by task with clear descriptions and corresponding costs.

- Regular Updates: Provide billing updates regularly to avoid surprises and build trust.

- Accurate Time Tracking: Implement time tracking tools to provide precise billing based on actual hours worked.

- Expense Clarity: Clearly state reimbursable expenses, providing receipts and ensuring transparency.

- Payment Schedules: Define payment milestones to help manage client expectations and firm cash flow.

- Late Payment Policies: Establish terms for overdue payments, including any fees or interest charges, to encourage timely remittance.

By adopting these practices, architects can maintain a professional and financially sound relationship with their clients, ensuring that their dedication to design is commensurately recognized in their financial compensation.

Balancing Aesthetics and Affordability

Architectural design often involves a delicate equilibrium between artistic vision and financial constraints. The convergence of aesthetics and affordability is critical for the successful execution of design projects.

Cost-Effective Creativity

Designers face the challenge of achieving visual excellence without compromising cost-effectiveness. Strategies such as 3D printing have emerged as transformative tools that enable complex designs at reduced costs.

This technological innovation allows architects to experiment with intricate forms while controlling expenditure.

How to Maintain Design Integrity While Adhering to a Budget

Maintaining design integrity within budgetary limits necessitates a comprehensive approach. It involves not only thoughtful material selection and construction methods but also a holistic vision that marries functionality with style.

An example of cost-saving yet effective design choices includes adaptive reuse of existing structures, which can satisfy aesthetic desires while avoiding the financial burden of new construction.

Research indicates that incorporating sustainable practices not only benefits the environment but also reduces long-term costs.

Utilizing natural light, selecting local materials, and incorporating thermal mass are some effective design choices for both cutting costs and enhancing aesthetic appeal.

These strategies generate savings by reducing energy consumption and thereby operational costs, fitting both sustainable design and budgetary objectives.

Investment in Innovation: The Role of Financial Management in Architecture

In the world of architecture, innovation doesn’t come cheap, but wise financial organization can be the lever that amplifies creative endeavors into practical, forward-thinking projects.

Funding the Future of Design

In architecture, investment strategies are the scaffolds that support the realization of cutting-edge design. They bridge the gap between conceptual sketches and constructed spaces.

In this realm, financial managers for architecture firms work diligently to allocate funds in a manner that enables creativity while maintaining economic viability.

This may involve engaging with new architectural firms and aiding them in creating robust business plans, which build a sturdy foundation for innovative work.

Trends in Financial Management for the Architecture Industry

The architecture industry constantly adapts to new financial trends that directly influence the success of design projects.

These trends, like cost-effective renewable materials, play a pivotal role in shaping the methods through which architects conceptualize sustainability and efficiency in their work.

By incorporating comprehensive financial analysis, firms can steer their projects toward economical sustainability while pushing the envelope of architectural design.

Tools of the Trade: Software for Financial Management

Effective fiscal management in architecture firms hinges on using the right software tools. These tools cater to the specific needs of architects, from project costing to revenue tracking, for streamlined operations.

Digital Dollars and Sense

Selecting the right financial software is crucial for architects. It ensures accuracy in financial reporting and helps maintain the firm’s financial health.

With dedicated architecture accounting software, firms can automate complex processes, ensuring they manage their financials with efficiency.

There are specialized software tools designed for the architectural industry that offer customized solutions for financial administration.

For instance, platforms like Monograph offer essential insights on optimizing financial operations within a design firm.

These tools are not only about keeping books in order but also about enhancing profitability and strategic planning.

Features to Look for in Financial Management Software

When evaluating software, architects should consider the following features to ensure comprehensive financial oversight:

- Project Cost Tracking: Tools that allow for real-time cost monitoring of each project.

- Invoicing and Billing: Automated systems for creating and sending invoices, tracking payments, and managing accounts receivable.

- Revenue Projections: Ability to forecast future revenues based on ongoing projects and potential leads.

- Financial Reporting: In-depth reporting functions for profit and loss statements, balance sheets, and cash flow analysis.

- Budgeting Tools: Functionalities for setting up and tracking overhead expenses against the budgets.

- Timesheet Management: Integration capabilities for tracking billable hours and personnel costs.

It’s these functionalities that arm architects with the ability to make informed financial decisions throughout the life cycle of their design projects.

Engaging with the Client: Transparency in Financial Discussions

Successful architectural projects hinge on clear, transparent financial discussions between the architect and the client. Establishing a mutual understanding of the project’s financial landscape is critical for fostering trust and ensuring a smooth collaboration.

Building Trust through Numbers

Architects who practice financial transparency with clients establish a solid foundation of trust. By presenting clear and detailed budgets and explaining the cost implications of each design decision, architects can help clients understand how their investments are being utilized.

Trust is facilitated when clients see that their budget aligns with their objectives, and they are kept abreast of the financials throughout the project lifecycle.

Tips for Communicating Financial Matters Effectively with Clients

When engaging in architect-client financial communication, it’s imperative to:

- Be clear and concise: Use simple language free from industry jargon.

- Consistency is key: Provide regular financial updates to avoid surprises.

- Legitimize with visuals: Use charts and tables to make financial data more digestible.

- Invite questions: Encourage clients to ask about financial details for better understanding and alignment.

These strategies foster an environment where financial discussions are a constructive part of the design process, rather than a source of conflict.

Conclusion

Architects must navigate a complex financial landscape that demands robust planning and strategic execution. They are tasked with not only designing structures but also ensuring that their financial infrastructure is just as sound.

It is imperative for professionals in the field to approach each project with a thorough financial plan that addresses potential risks and opportunities.

The financial fortitude of an architecture practice relies on meticulous planning, active management, and continual education.

By committing to such principles, architects can navigate the financial landscape with confidence, ensuring the sustainability of their projects and the prosperity of their practice

Financial Hurdles? Let’s Clear the Path.

Dread the tangle of tax, payroll, and bookkeeping? Imagine a future where financial obstacles don’t stand in your way. Papillon House isn’t just about numbers; we’re your strategic ally in crafting a financial path as ambitious as your business dreams.

Beyond mere numbers, we offer a comprehensive suite of services: QuickBooks cleanups, strategic tax planning and filing, precise payroll management, and meticulous monthly bookkeeping.

Each service is a step towards turning financial challenges into triumphs, ensuring no detail is left to chance.

Dive Deeper now—Connect with us. Transform financial complexity into your competitive advantage.

Frequently Asked Questions

What financial considerations are crucial for architects when starting a design project?

Understanding the project’s scope, budget forecasting, and cost analysis are essential to ensure profitability and manage client expectations.

How can bookkeeping help architects manage project costs more effectively?

Proper bookkeeping allows for real-time tracking of expenses, enabling architects to stay within budget and adjust project parameters as needed.

What role does tax planning play in architectural businesses?

Strategic tax planning can identify deductions and credits specific to architectural projects, optimizing financial performance.

Why is payroll management important for architectural firms?

Efficient payroll management ensures that staff are compensated accurately and timely, which is vital for maintaining morale and compliance with labor laws.

Can bookkeeping software integrate with other tools used by architects?

Yes, modern bookkeeping software can integrate with project management and design software, streamlining workflow and financial tracking.

How do architects benefit from professional bookkeeping and financial advisory services?

Professional services provide expertise in financial management, tax strategy, and compliance, allowing architects to focus on design and innovation while optimizing their financial health.

About Morgan

Morgan is the Director at Papillon House Bookkeeping, a Tampa, Florida-based firm that specializes in bookkeeping services for law offices, architects, and the construction industry. With over three years of experience in her current role, she aids her clients in meticulously organizing their financials. Morgan's dedication and expertise extend beyond the realm of accounting, allowing her to provide comprehensive financial management solutions. She also engages with her audience through live discussions on the Papillon House Bookkeeping Facebook group page.